Australian Tax Office – Scam Alert

We want to alert you to recent scams exploiting the myGovID name change. Scammers are using phishing emails, fake websites, and calls to steal your information.

The below is an extract of a recent newsletter received from the ATO.

November 2024 – myGovID and myID scams

We are seeing ATO impersonation scams relating to the upcoming name change of myGovID to myID, which is occurring in mid-November.

myID is a new name and will have a new look – but it will still be used the same way.

There is nothing the community needs to do to prepare for this change.

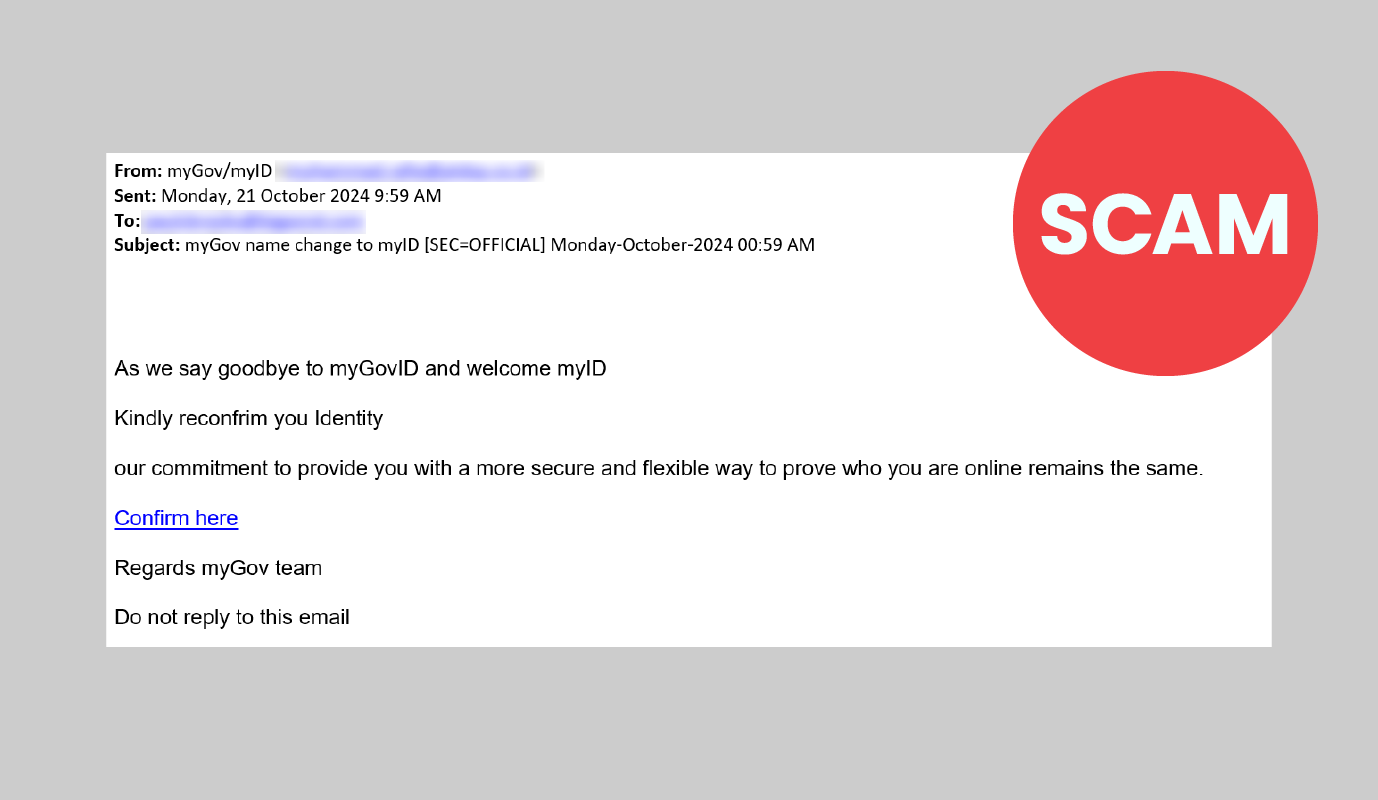

You don't need to set up a new myID or reconfirm your details as part of this change. If you are asked to do this, it's a scam.

We have been communicating about this change through activities (including email) to current myGovID users.

Scammers are trying to trick the community into thinking they need to reconfirm their details via a link. The link directs users to a fraudulent myGov sign in page designed to steal personal information, including myGov sign in credentials.

These details can be used later in identity theft or other fraudulent activity such as refund fraud.

The following image is one example of the format this scam can take.

To protect yourself we remind you:

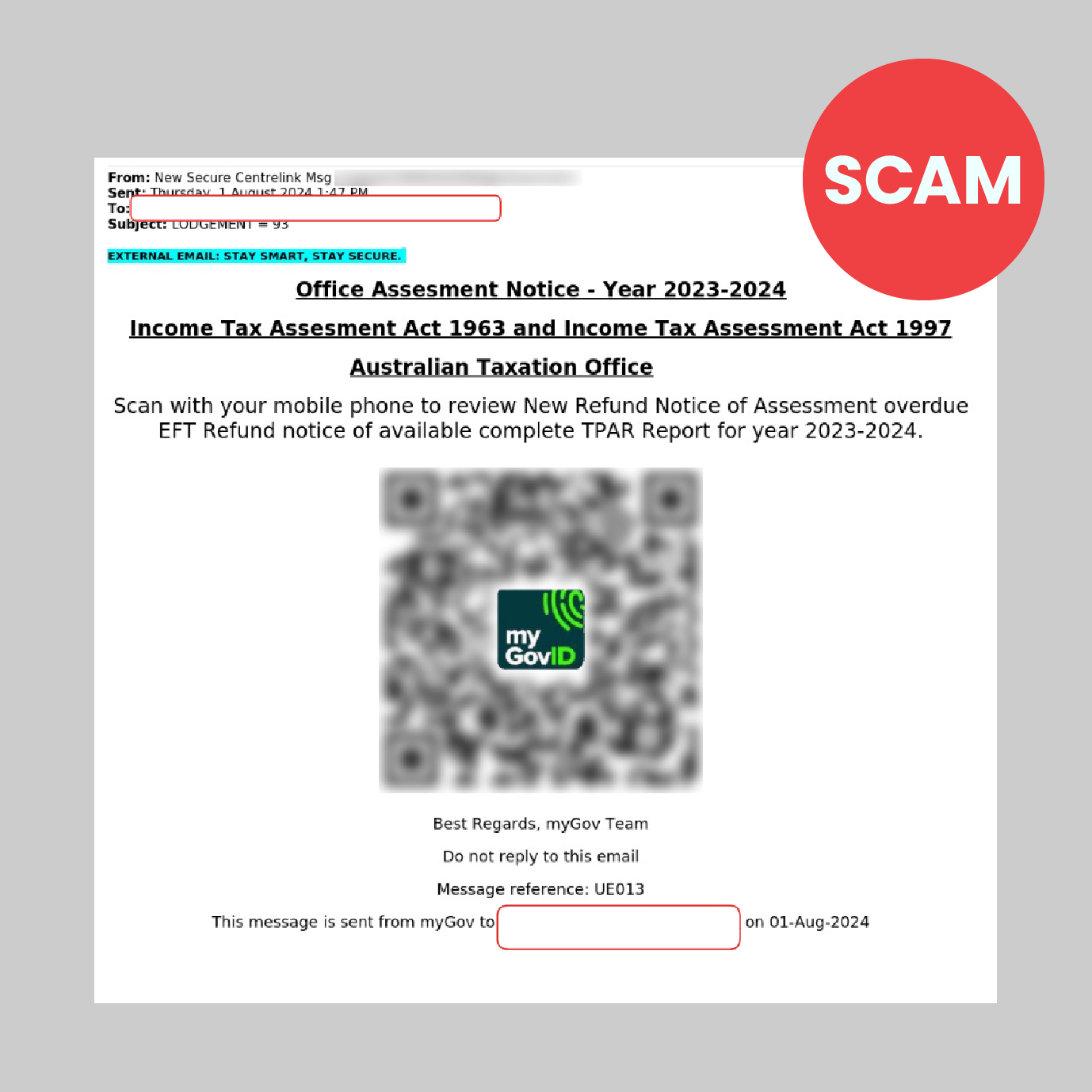

- We won't send you an SMS or email with a link or QR code to log on to online services. You should access them directly by typing ato.gov.au or my.gov.au into your browser.

- We will never send an unsolicited message asking you to return personal identifying information through SMS or email.

- Don’t click on links, open attachments or download any files from suspicious emails or SMS; we will never send an unsolicited SMS that contains a hyperlink.

- Only download the myGovID (soon to be myID) app from the official app stores (Google Play and the App Store).

- Never share your login code with anyone.

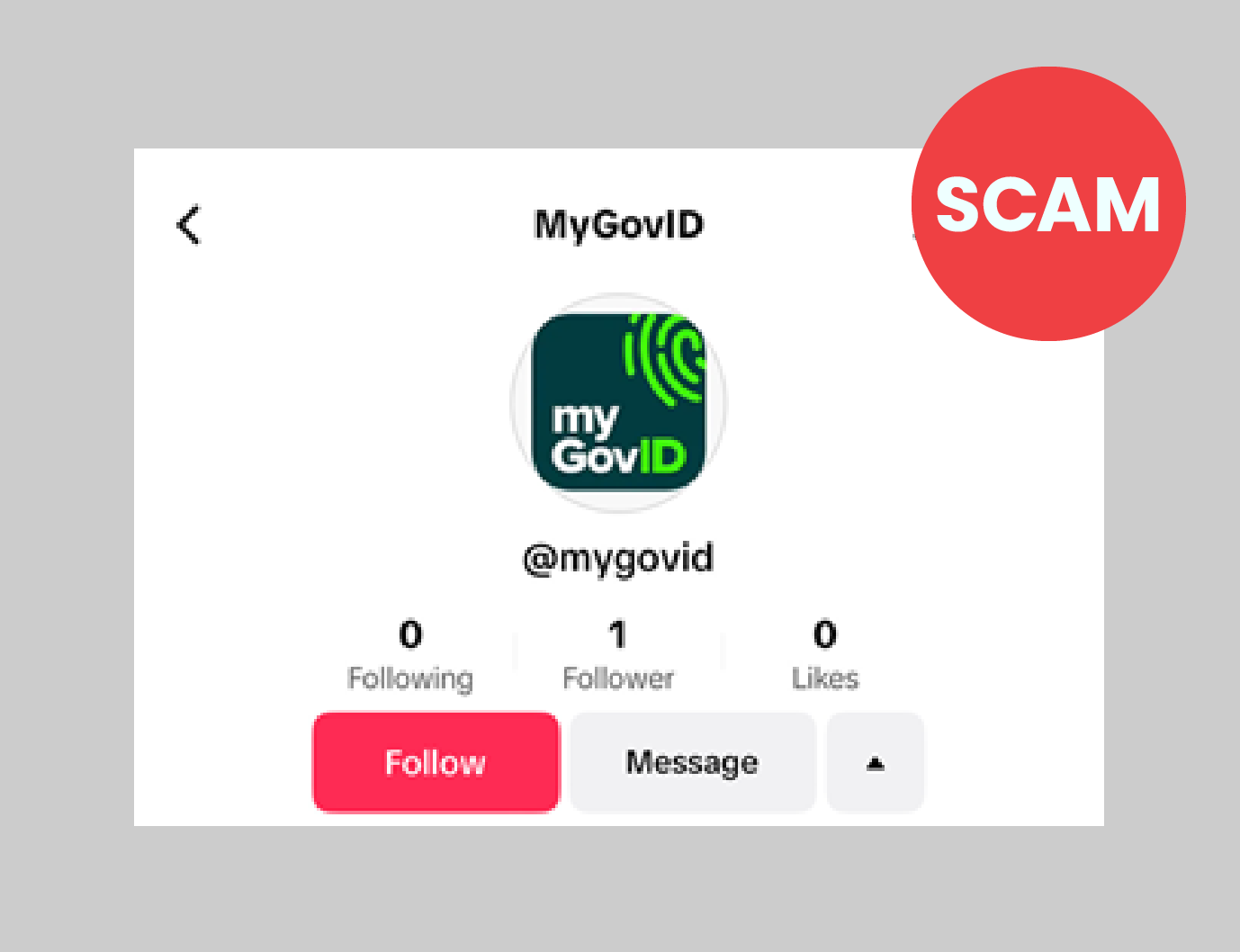

- We are on FacebookExternal Link, InstagramExternal Link, X and LinkedInExternal Link, but we will never use these social media platforms to private message, discuss your personal information, documentation, or ask you to make payments.

The following images are examples of other myGovID scams

For more detailed current scam alerts, click here

Please do not hesitate to contact Lowe Lippmann IT Department if you wish to discuss any of these matters further.

Liability limited by a scheme approved under Professional Standards Legislation