2024

Let us keep you informed

Learn more about tax areas and issues that may impact you.

Many business clients like to review their tax position before the end of the income year and evaluate any strategies that may be available to legitimately reduce their tax. Traditionally, year-end tax planning for profitable small businesses is based around accelerating deductions and deferring income. The Year End Checklist in the link below explains some common strategies that may be considered for all business taxpayers.

A strategy often used to reduce taxable income (and, in turn, tax payable) in an income year is to bring forward any expected or planned deductible expenditure from a later income year. However, any individuals with potentially reduced income for the 2025 tax season may want to instead consider deferring any deductible expenditure (if possible).

New standards at 31 December 2024 There are three new accounting standards to be considered for the first time for 31 December 2024 reporters. A summary of each of these standards has been considered below as well as potential impacts on our clients. Revised AASB 101 Presentation of Financial Statements provides additional guidance regarding presentation of liabilities as current or non-current. In particular, the standard includes more clarity around the existence of covenants and waivers / periods of grace in the event of a breach. Additional disclosures are required where covenants are tested after the reporting date. This is likely to have impact for many of our clients and we recommend that bank agreements are reviewed as soon as possible as well as identification of potential covenant breaches. AASB 2022-5 Amendments to Australian Accounting Standards – Lease Liability in a Sale and Leaseback clarifies how a seller-lessee should measure lease liabilities arising from a sale and leaseback transaction. It ensures that the leaseback does not lead to the recognition of gains that aren't aligned with the right-of-use asset retained. Expected to have little impact, generally if our clients enter sale and leaseback arrangements, there is a failed sale as control is not transferred from the selling entity. AASB 2023-1 Amendments to Australian Accounting Standards – Supplier Finance Arrangements (2024-1 for Tier 2) introduces new disclosure requirements to enhance transparency about the nature, timing, and amount of liabilities financed by suppliers in relation to the effects of such arrangements on an entity’s liquidity risk and leverage. Little impact expected, however disclosure amendment only.

What Should Be on the Board/Management Committee Agenda for NFP and Smaller Entities? We are fast approaching the end of the calendar year – the second most common reporting date for entities in Australia. Board and Management committees (Boards) of not-for-profits (NFPs) and small entities will be considering their annual reports and the 2025 outlook and as part of this project, it will be time to ensure the Board attention areas are appropriate. Boards should focus on current and emerging risks to ensure their organisations remain resilient and effective – the normal items of financial management, governance, and strategic planning remain relevant, however other key matters which should be included are: Cybersecurity: Ensure your organisation is protected against increasing cyber threats and has robust data protection measures in place, including knowing what data is collected and retained by the organisation. Climate Risk: Evaluate how environmental changes impact operations, funding, and long-term sustainability and whether there is impact from the mandatory climate-reporting risk regime on your suppliers which may impact you. Diversity & Inclusion: Ensuring your governance and decision-making reflect the community your organisation serves, and the appropriate voice is being heard. Digital Transformation: Discuss emerging technologies for operational efficiency and addressing any digital gaps. Ensure appropriate policies for the use of AI are in place. Staffing and Succession Planning: Regularly review staffing levels, development opportunities, and establish succession plans for key roles, such as the Chair of the Board, CEO or General Manager. Geopolitical situation: Consider any likely impacts from the current world uncertainty and overseas elections including supplier and beneficiary locations, changes in exchange rates and interest rates.

Christmas Parties & Gifts 2024 With the well-earned 2024 holiday season on the way, many employers will be planning to reward staff with a celebratory party or event. However, there are important issues to consider, including the possible FBT and income tax implications of providing 'entertainment' (including Christmas parties) to staff and clients.

Can staff celebrations attract FBT? With the holiday season coming up, employers may be planning to celebrate with their employees. Before they hire a restaurant or book an event, employers should make sure to work out if the benefits they provide their employees are considered entertainment-related, and therefore subject to fringe benefits tax ('FBT'). This will depend on: the amount they spend on each employee; when and where the celebration is held; who attends — is it just employees, or are partners, clients or suppliers also invited? the value and type of gifts they provide. Employers who do provide entertainment-related fringe benefits should keep records detailing all of this information so they can calculate their taxable value. We will be releasing a full Tax Alert on this topic next week.

Australia's New Climate Reporting Laws: What Do They Mean for Small and Medium-Sized Entities? Australia's Senate has just passed a Bill introducing mandatory climate-related reporting for large entities, but what does this mean for small and medium-sized businesses? While you may not be directly required to comply, there is still a significant impact to consider. One of the key areas affected is Scope 3 emissions reporting, which includes the emissions generated along the supply chain. This means that if your entity is part of the supply chain of a mandatory reporter, they will likely need detailed information for you to accurately report their own emissions. This is where proactive preparation can benefit you. A first step is to identify which entities in your value chain may be affected and start the conversation with them. You can then consider your carbon footprint: including how much energy does your business consume and your main sources of emissions. By gathering and tracking this data now, you can provide the necessary information to your larger partners, helping them comply with the new requirements. For example, if you are a small manufacturer supplying products to a large retailer, that retailer will need to report the emissions associated with the production, transportation, and even the disposal of your products. Being able to provide them with accurate emissions data not only strengthens your business relationship but also positions you as a responsible and forward-thinking partner. Preparing now for these regulatory changes could give you a competitive edge. Climate-related reporting is gaining momentum globally, and staying ahead of the curve will ensure your business is ready to meet any new obligations.

Tax Alert - Reminder of changes to Vacant Residential Land Tax rules in Victoria from 1 January 2025

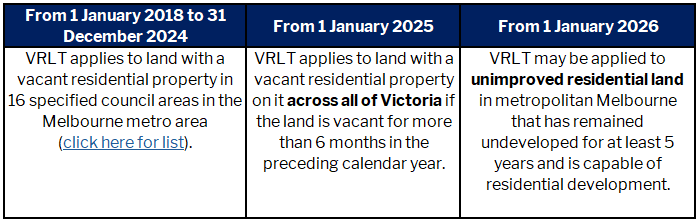

Reminder of changes to Vacant Residential Land Tax rules in Victoria from 1 January 2025 Background Vacant residential land tax ( VRLT ) may apply to residential land that is vacant for more than 6 months in the preceding calendar year (ie. from 1 January 2024 to 31 December 2024). Residential land can include: land with a home on it; land with a home which is being renovated or where a former home has been demolished and a new home is being constructed; or land with a home on it that has been uninhabitable for 2 years or more. Residential land does not include land without a home on it (sometimes called unimproved land), commercial residential premises, residential care facilities, supported residential services or retirement villages. The scope of what types of residential property will be exposed to the VRLT rules is being expanded over time, as follows:

Hiring employees for the festive season As the festive season approaches, employers that hire new employees to help with their business should remember the following when it comes to their employer tax and super obligations: Employers should make sure they are withholding the right amount of tax from payments they make to their employees and other payees, especially as this will help their employees meet their end-of-year tax liabilities; Employers must pay super guarantee (currently at 11.5%) to all eligible employee's super funds in full and on time to avoid paying the super guarantee charge; and If employers are still not reporting through single touch payroll (STP) and they do not have an approved exemption, deferral or concession in place, they should start reporting now. If they have just started a business or recently employed staff, they will need to report through STP from their first payday.