Tax Alert - Government announces changes to planned Stage 3 tax cuts

Government announces changes to planned Stage 3 tax cuts

The Federal Government has now announced changes to the marginal tax rates (and income thresholds, or brackets) starting from 1 July 2024. The announcement is a move away from the planned “Stage 3 tax cuts”.

What were the planned Stage 3 tax cuts?

The previous Coalition Government announced a long-term plan to implement three stages of reduced marginal tax rates and brackets between the 2018-19 and 2024-25 income years, with the final Stage 3 tax cuts due to start from 1 July 2024.

The current Labor Government agreed in the last election to keep these changes.

What are the announced changes?

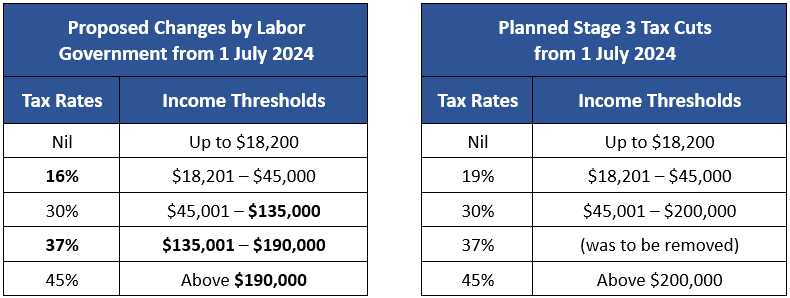

The changes to the Stage 3 tax cuts will now provide lower to middle income earners with greater tax relief and effectively halve the tax cuts for higher income earners.

The following two tables show the changes highlighted in bold text.

We note that the re-introduction of the 37% tax bracket (which was planned to be removed), along with the replacing the 19% tax rate with a 16% tax rate, will impact taxpayers earning more than approx. $150,000. While these taxpayers will still receive a tax benefit, they will now receive a smaller net tax benefit from the proposed changes, compared to the net tax benefit under the planned Stage 3 tax cuts.

All taxpayers earning less than approx. $150,000 will receive an additional net tax benefit from the announced changes.

Please do not hesitate to contact your Lowe Lippmann Relationship Partner if you wish to discuss any of these matters further.

Liability limited by a scheme approved under Professional Standards Legislation